How Do You Choose A Real Estate Agent?

Picking the right agent can be the difference between landing your dream home or watching from the side-line. So make sure you know how to weed out the winners from the pretenders.

Do your research and ask questions. Not all Real Estate Agents are the same. If you decide to seek the help of an agent when selling or buying your home, you need some good information before you make any moves. Picking an agent is one of those critical issues that can cost or save you thousands of dollars. There are very specific questions you should be asking to ensure that you get the best representation for your needs. Here are some examples of questions you should ask: What makes you different? Why should I list my home with you? What are your company’s track record and reputation in the marketplace? What are your marketing plans for my home? On average, when your listings sell, how close is the selling price to the asking price?

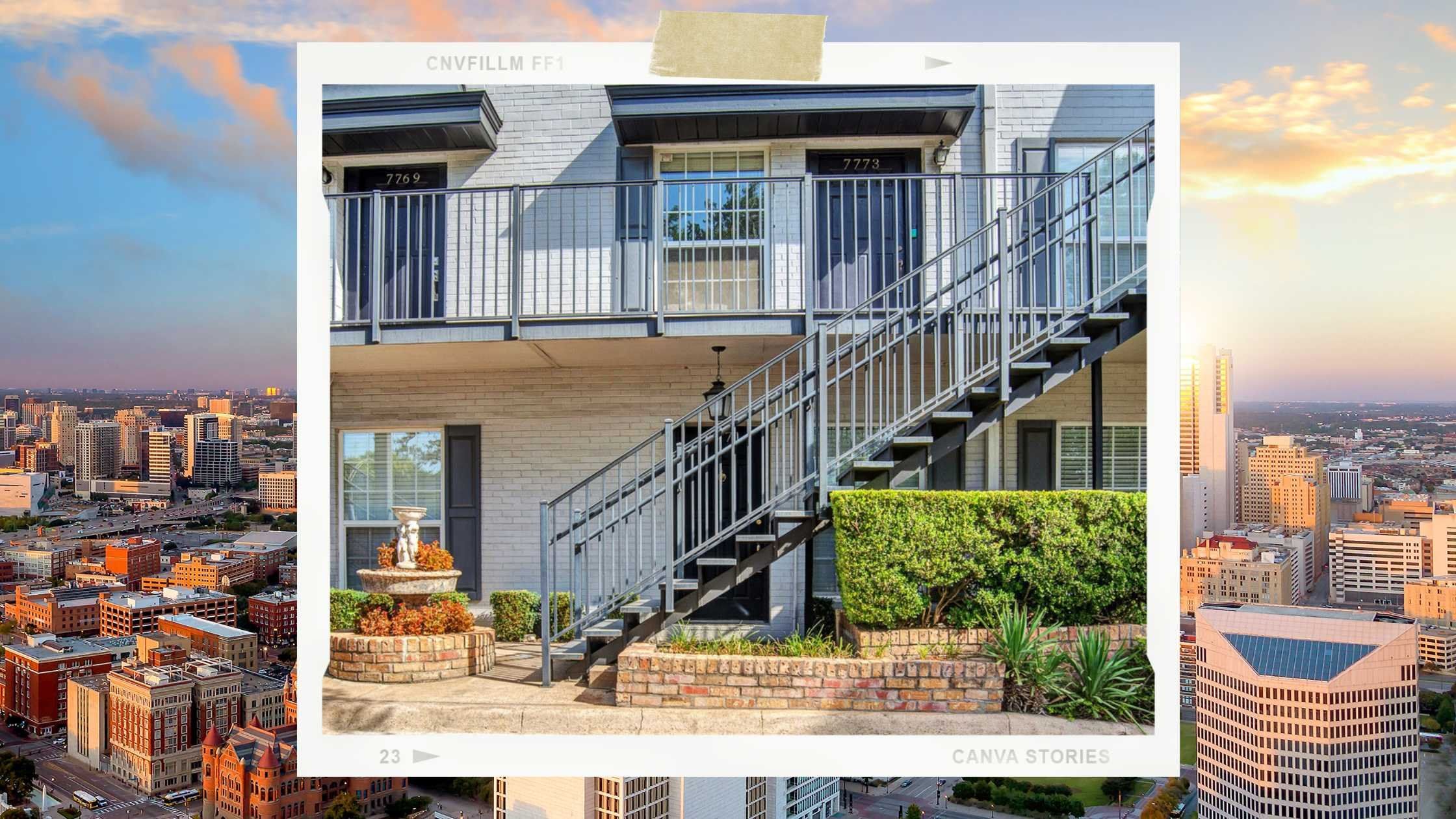

How Do You Choose A Location?

“Location, location location” There is a reason this age old line still rings true today!

Choose somewhere that fits your lifestyle. Some people prefer a short commute and being close to shopping centers, but on the other hand, some families have grown tired of the hustle and bustle and prefer to live tucked away in the suburbs or even the countryside. When choosing a location, select a place that will cater to your needs now, and down the road. Don’t set your heart on just one house or neighborhood, either. Start by identifying what you like about your dream neighborhood and think about what you could compromise on if you can’t find everything you want within your budget. Don’t forget to investigate the HOA to ensure you’re compatible, too! Homeowners Associations can be great for many communities because they provide a set of standards to ensure that all residents are living in a place that values beautification and resale value. On the other hand, some folks find the HOA to be too involved, and the decisions of the board may not always be best for everyone. We suggest attending a board meeting, meeting with the manager, checking the association’s budget, examining the curb appeal in the daylight and evening, and reading the rules and regulations.

Should I Get Pre-approved?

In a competitive market there is no time to waste! If you find your dream home immediately you want to be ready to secure it.

You can, and should, get pre-approved for a mortgage before you go looking for a home. Pre-approval is easy and can give you complete peace of mind when shopping for your home. Your local lending institution can provide you with written pre-approval for you at no cost and no obligation, and it can all be done quite easily over the phone. More than just a verbal approval from your lending institution, a written pre-approval is as good as money in the bank. It entails a completed credit application and a certificate that guarantees you a mortgage to the specified level when you find the home you are looking for.

How Do You Win An Offer?

Multiple offers have become commonplace. Knowing how to make yours stand out is key!

A personal touch when there are multiple offers is a great way to stand out in a pool of potential buyers. This isn’t a send-all-be-all, sometimes, your offer just can’t compete with the others, but if you have a similar offer to other buyers, a personal touch can be a great way to pull at the heartstrings of the seller and have a much better chance of being selected.

What Are The Costs Involved?

A good agent will be upfront with you about all the costs you can expect when purchasing a home. That being said, it is important to know what to expect.

Most first-time home-buyers concentrate on the down payment—the largest of all the out-of-pocket expenses—but there are plenty of other fees required for a property purchase that you should be aware of before starting the process. Closing costs, realtor commission, origination fees, legal fees, property taxes, HOA dues, insurance premiums, etc. are all costs you should be aware of and speak with your agent and mortgage lender about before sealing the deal.

Should I Buy A Home Below My Means?

When it comes to your finances, it is important to choose the best option that benefits you and your family.

Our experts recommend that you spend the least amount possible on a home that meets your needs and makes you happy, even if you have plenty of money to spend on it. Rather than struggling to pay for something at the top of your budget, aim for a home that is 75% or less of what you’re approved for to be able to save more effectively for retirement, emergencies, travel, and to enjoy your life without fiscal burden.

Buy Any Home From Us & If You Are Not Completely Satisfied We Will Buy It Back Or Sell It For FREE* No Gimmicks! For more information on this Peace of Mind Guarantee, give us a call today!

—

Your Price Is Our Promise® Your Home SOLD 100% of the Asking Price or We Will Pay You the Difference! Call us a call today!

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.